Debunking these 6 top ERC myths will help you qualify for, and easily collect the Employee Retention Tax Credit money your small business deserves.

The CARES Act of 2020, CAA of 2020, ARPA of 2021 and ERTCs

Thanks to the CARES Act of 2020, the CAA of 2020, and ARPA 2021, Employee Retention Tax Credits, often referred to as Employee Retention Credits, ERTCs, or ERCs for short, were created to help small- to medium-sized businesses financially impacted by COVID-19 keep employees on their payrolls.

How Much Money Are my Refundable ERCs Worth?

Spoiler alert: If you’re like most business owners, you will be pleasantly surprised by how much your ERCs are worth. In fact, it’s commonplace to receive checks for hundreds of thousands of dollars. The easy math works out to $26K per employee.

For 2020, the credit is calculated by taking 50% of the first $10K of qualified wages for the year. The credit is limited to $5K per employee for all of 2020. This applies to employers with fewer than 100 employees.

For 2021, the ERC program greatly expanded. The credit is 70% of the first $10K of qualified wages in quarters one, two, and three, and applies to employers with fewer than 500 employees. This works out to up to $21K per employee.

Myth #1: Our Gross Revenue Increased So We Didn’t Qualify

Having a gross revenue reduction isn’t the only way to qualify for these refundable payroll tax credits. The second possible way to qualify is based on business impact.

If due to any COVID-19 related government order, your business operations were impacted, or changed during a specific calendar quarter, then you probably qualify.

Here are some examples of Yes/No questions businesses use to help determine if their business was impacted while under a federal, state, or local executive order:

- Did you have to change your hours of operation due to COVID-19?

- Was your trade or business partially suspended?

- Did your business experience any supply chain issues?

- Was there a reduction in capacity due to social distancing?

- Was your business unable to fully staff due to special restrictions?

- Were you affected by partial shutdowns by other businesses?

- Did COVID-19 restrictions limit business commerce, travel, or meetings?

Good news. YES, answers generally indicate your business qualifies.

Myth #2: Our Gross Revenue Didn’t Drop by 50% or More

A 50% or more was the requirement for 2020. However, in 2021 the eligibility rules changed, and you only need to have a 20% or more reduction in gross revenue to qualify.

The key to understanding the ease of qualifying, is remembering that you’re comparing your quarterly gross receipts to the same period in 2019—a pre-pandemic year when your business was likely thriving.

So, although 2021 revenue wasn’t that bad, the good news is that for 2021 the eligibility threshold is much lower, making it possible for more businesses to qualify.

In terms of declining revenue, think of the pandemic as a cloud with a silver lining. The only way to benefit from this silver lining is to apply for an ERC.

Myth #3: It’s Too Late to Apply for an ERC

This myth is easily slayed with one word—amended. Simply file an amended 941-X form for your 2020 and 2021 tax returns. The 941-X form applies to prior quarters including those in 2020. So, if your eligible business failed to claim an ERC—it’s definitely in your best interest to file now or forever give up what may amount to a lot of money for your business.

Myth #4: I’m Not Eligible for ERCs Because I Already Got PPP Loans

The good news is that you can apply for PPP loan forgiveness AND an ERC. The only consideration is that you don’t double-dip. You can’t claim an ERC for the same payroll periods you used for your PPP loans.

The way Baron accomplishes this is to segregate payroll periods by determining which periods are necessary for PPP loans, and which are best for maximizing ERCs.

Ready for some even better news? Up to 40% of your PPP loan forgiveness can be applied to non-payroll expenses. This means you will have more qualifying wages to apply to your ERC. That’s what Baron calls having your cake and eating it too.

Myth #5: An ERC is Just a Tax Credit

NO—it’s real money! Think of an ERC as exactly what it is—a refundable tax credit that’s paid to you in cash. Or as Cramer from Mad Money might shout, “Booyah!”

Seriously. Appreciating the full weight and impact of the pandemic upon small businesses, Congress got it right when they created ERCs. As a tax credit it doesn’t need to be funded, and therefore cannot run out of money. Simply file, and your check will arrive by mail.

Myth #6: I Was Told We Don’t Qualify for an ERC

Sadly, there’s a lot of misinformation out there. Over 50% of eligible businesses are not even aware that they qualify. The ERC was designed to reward business owners for retaining employees throughout the COVID-19 pandemic.

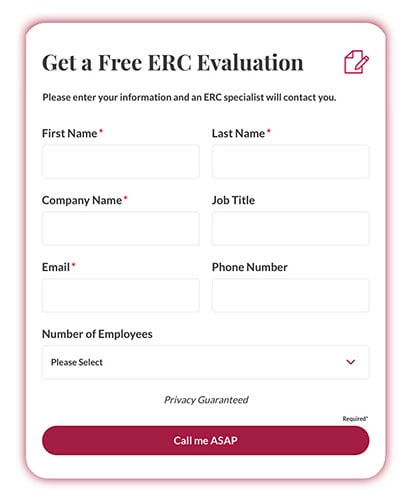

Not every business adviser is an ERC specialist. So, before passing up on the money you could’ve gotten by applying for an ERC, it’s in your best financial interest to work with an ERC expert. And if you’re in doubt, call Baron—that’s our jam, it’s why we’re here—to put money in your pocket, where it belongs.