You're here because you want to file your Employee Retention Tax Credit 941-X payroll tax refund and get your money.

This is a complex process. And without doing it right, you could be out thousands of dollars.

So, with that said...

You have two options to file:

- Do it yourself.

- Work with an experienced professional.

Do it yourself.

We've developed this step-by-step how to guide to help you understand and file your Employee Retention Tax Credit 941-X payroll tax refund. Please remember, this article was written as a general guide and is not meant to replace consulting with tax experts.

Work with an experienced professional.

Filing your 941-X is complicated.

So, if you want a professional that's successfully prepared and filed payroll tax returns for over twenty years to do it for you, schedule a free 10 min call to talk with an advisor.

During the free call, we will talk about:

- How to see if you qualify.

- How to find out how much money you may be owed.

- Transparent pricing for our services.

Step-by-Step Guide to Doing It Yourself

The 941-X tax refund form was created to help you amend the 941 Forms you filed in 2020 and 2021. Now that you’re allowed to have both your PPP loans AND ERTCs, you will need to revise your 941s that you filed with the IRS in previous quarters.

Most small business owners will start calculating their ERC amounts in the first quarter of 2020, when the pandemic began. However, since the ERC credits started so late in the first quarter (began March 13, 2020), the IRS required all business to include the first quarter adjustments on with the second quarter adjustments, and file both on the second quarter 2020 941X.

Get your 941-X questions answered by the experts at Baron Payroll

For each quarter that you have qualified wages for the ERC, you will need to file amended 941x payroll tax returns to get your refund checks from the IRS.

If you haven’t applied for an ERC yet, all you need to do is file an amended Form 941X for the quarters you were an eligible employer.

IRS Forms 941, 941-X, and 5884-D Worksheet

IRS About Form 941, Employer's Quarterly Federal Tax Return

IRS Instructions for Form 941-X

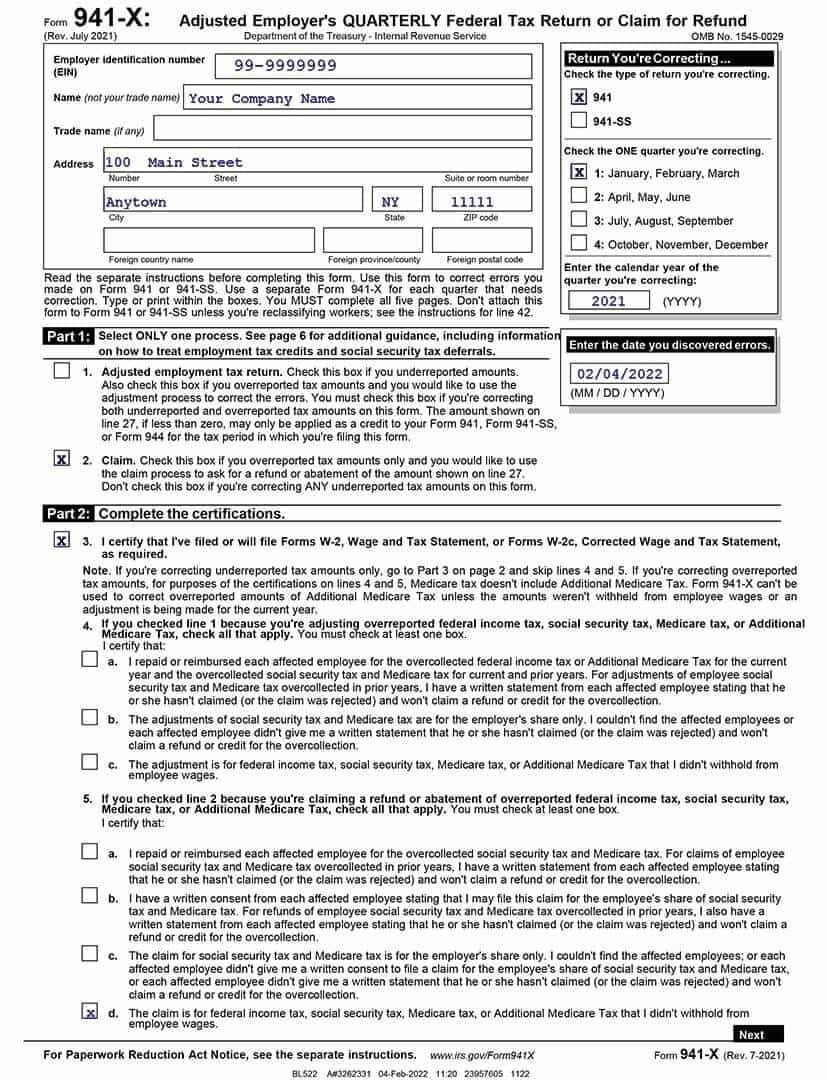

Form 941-X - Page 1

Make sure you fill-in the required info on page header, such as company name, EIN number, quarter and year.

Step 1: Determine which payroll quarters in 2020 and 2021 your business qualifies for.

Step 2: For all quarters you qualify for, get your original 941, a blank 941-X, and payroll journals for each quarter.

Step 3: Fill out your company info. Select the Return You’re Correcting (941), and the quarter and year you’re correcting.

Step 4: Select the calendar year of the quarter you’re correcting.

Step 5: Select the date you discovered errors in your 941 Form. You can use the date you complete this 941-X Form.

Step 6: In Part 1, select whether you’re doing an Adjusted employment tax return, or a claim – most likely you will select box 2, Claim.

Step 7: In Part 2, check box 3. Then check box 5d, stating that the claim is for tax I didn’t withhold from employee wages.

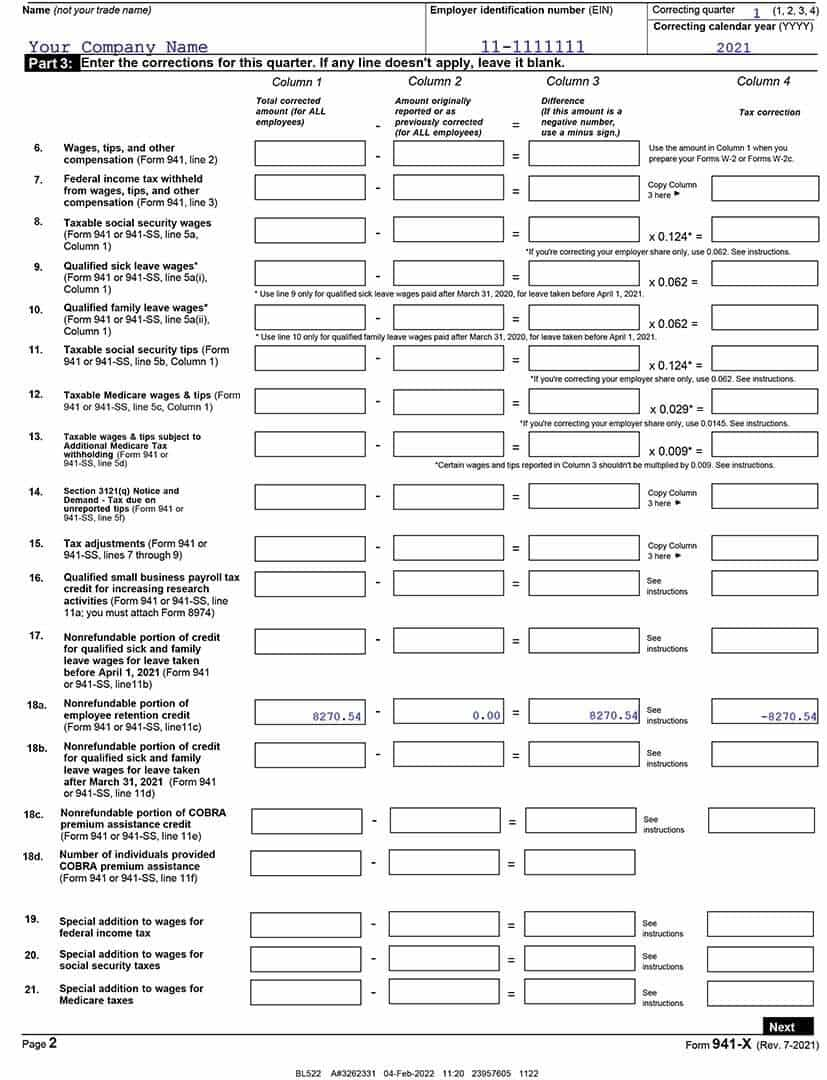

Form 941-X - Page 2

Step 8: On Page 2, Part 3, Line 18a, enter your nonrefundable portion of employee retention credit.

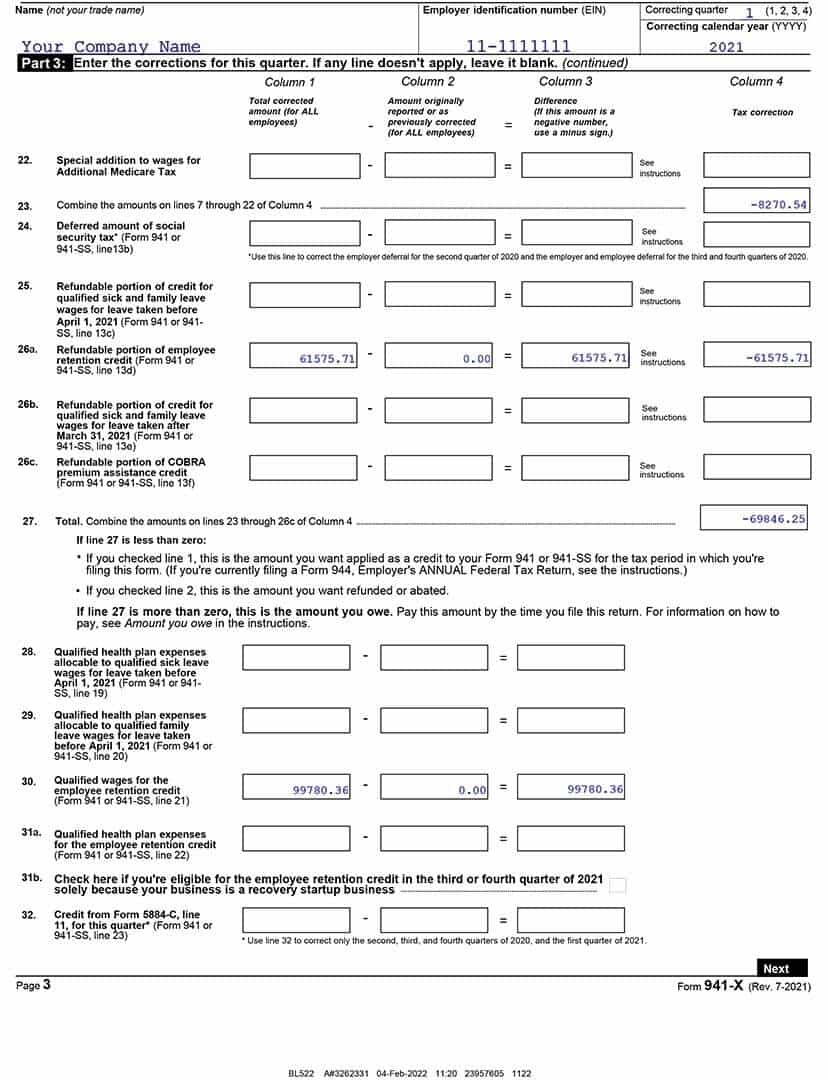

Form 941-X - Page 3

Step 9: On Page 3, Part 3, Line 23, combine the amounts on lines 7 through 22 of Column 4.

Step 10: On Page 3, Part 3, Line 26a, enter your refundable portion of employee retention credit.

Step 11: On Page 3, Part 3, Line 27, combine amounts on lines 23 – 26c of column 4 and enter total.

Step 12: On Page 3, Part 3, Line 30, enter your Qualified wages for the employee retention credit.

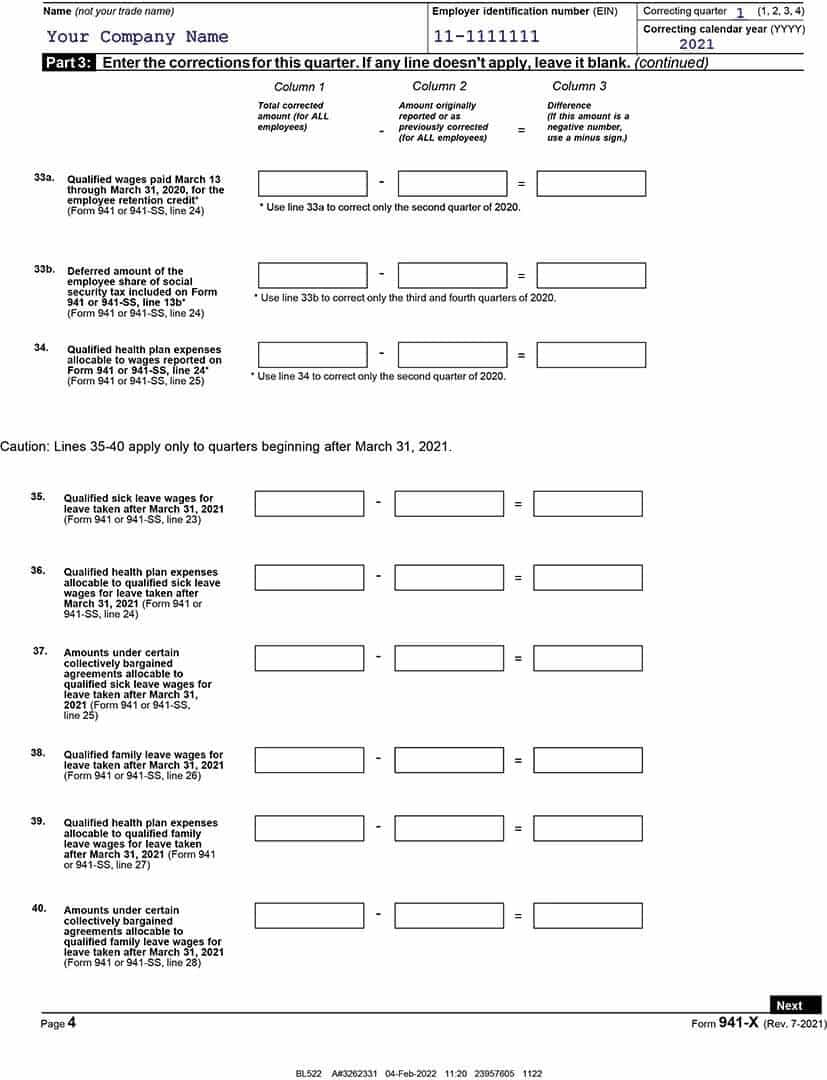

Form 941-X - Page 4

Under most situations, page 4 may be left blank.

Form 941-X - Page 5

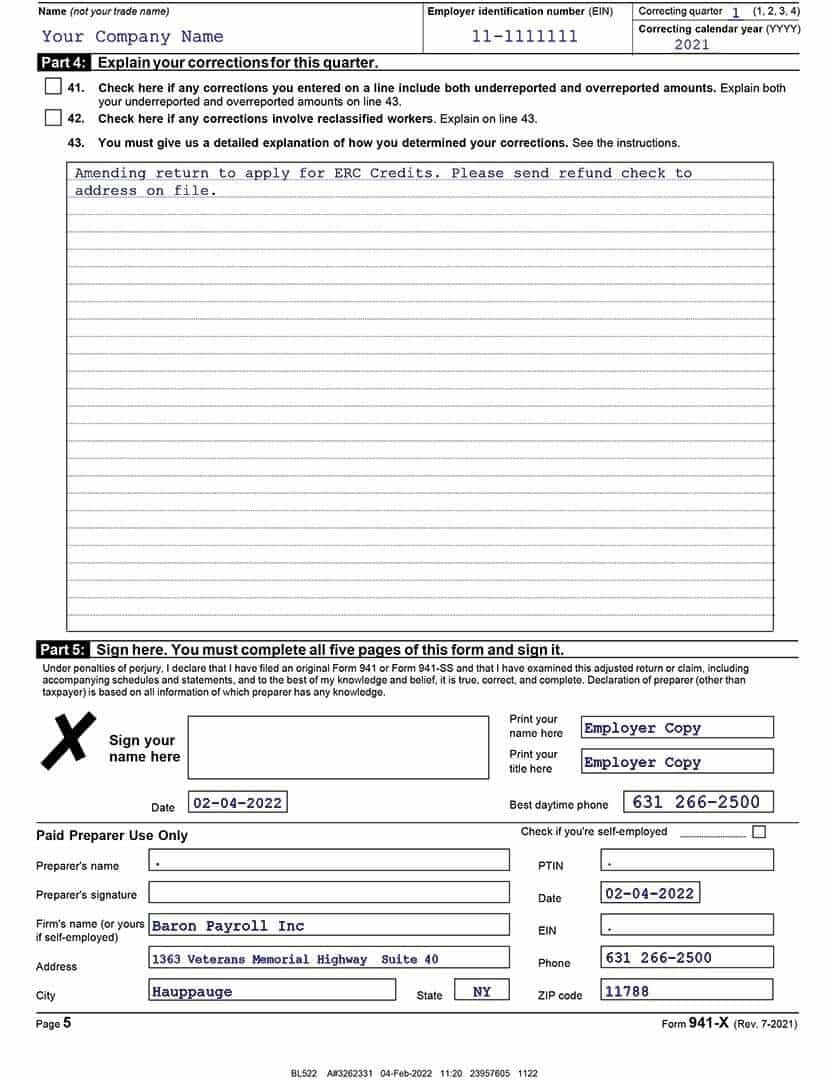

Step 13: On Page 5, Part 4, Line 43, provide a detailed explanation of how you determined your correction. Such as: Amending return to apply for ERC Credits. Please send refund check to address on file.

Step 14: On Page 5, Part 5, complete and sign as required.

That’s it! You’re all done! Congratulations on filling out your 941-X Refund Form. Simply send the form to the IRS and wait for your refund check.