One of the challenges faced by New York State business owners is staying compliant with Notice of Pay Rate labor laws and filling out the LS series labor forms.

Filing out the New York State LS series labor law forms is mandated under the Wage Theft Prevention Act.

What is the Wage Theft Prevention Act?

According to WTPA FAQs, the WTPA became effective on April 9, 2011. It gives greater protection to workers by making changes in the way they’re notified of their pay rates and how they receive wage statements.

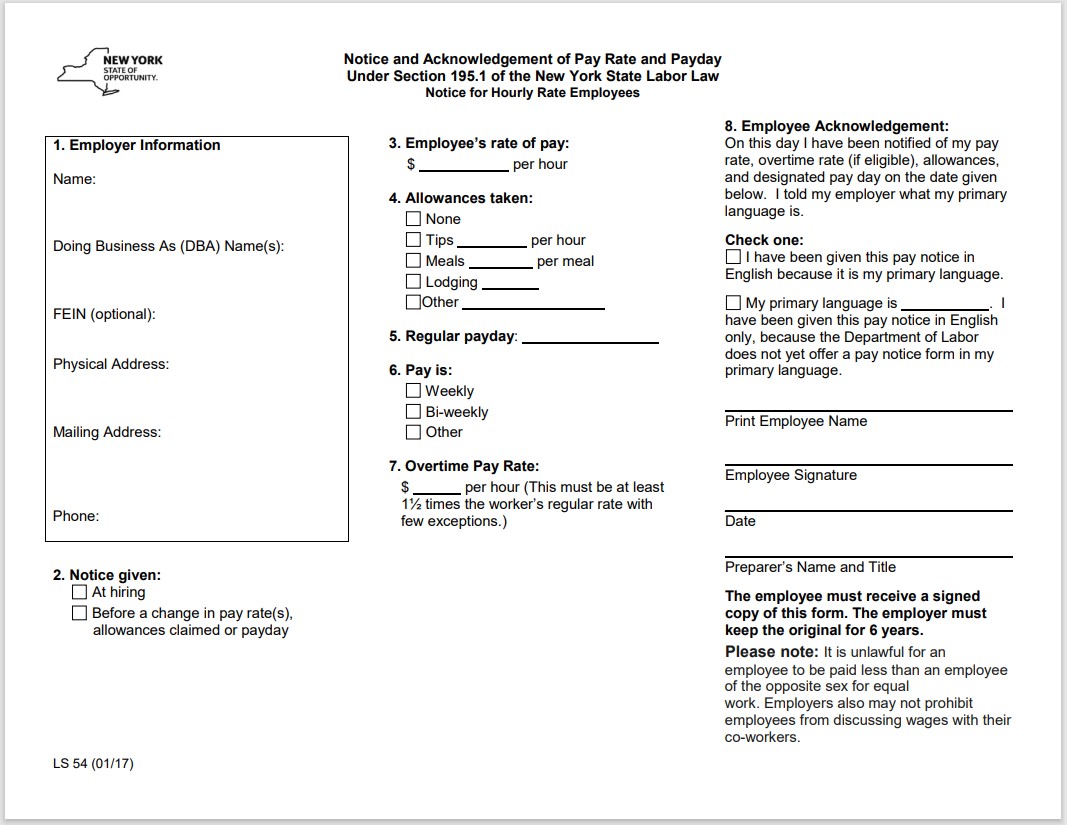

How do employers fill out the New York State Labor Law Form LS 54?

The LS 54 is the most used Notice of Pay Rate form. It is based on hourly wages. Fortunately, the LS 54, and other LS forms are very self-explanatory and easy to fill out. The important question to ask is which LS Form you need.

Which LS Forms do I need to fill out for my employees?

The LS form(s) your business needs to fill out will depend on the following employee wage specifics.

- Hourly wage employees - LS 54

- Multiple Hourly Rate Employees – LS 55

- Employees Paid a Weekly Rate or a Salary for a Fixed Number of Hours (40 or Fewer in a Week) – LS 56

- Employees Paid Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay – LS 57

- Prevailing Rate and Other Jobs – LS 58

- Exempt Employees – LS 59

- Pay Notice and Acknowledgement for Farm Workers – LS 309

Read on or contact us to discuss your New York State labor needs.

Who is covered by the Wage Theft Prevention Act?

All private-sector employers are covered. If you have employees who work in other states, they are not covered. Federal, state, and local government employers are also not covered. However, charter schools, private schools, and not-for-profit corporations are covered, as they are not public entities.

What does the Wage Theft Prevention Act require?

The Wage Theft Prevention Act (WTPA) requires New York State employers to give written notice of pay rates to each new hire.

This notice must include:

- Pay rates, including the overtime rate of pay (if applicable)

- How the employee is paid: by the hour, shift, day, week, commission, etc.

- Regular payday

- Official name of the employer and any other names used for business (DBA)

- Address and phone number of the employer's head office or principal location

- Any allowances that were taken as part of the minimum wage, such as tips, meals, and lodging deductions

- The notice must be given both in English and in the employee's primary language (if the Labor Department offers a translation). The Department currently offers translations in the following languages: Spanish, Chinese, Haitian Creole, Korean, Polish, and Russian. In addition, workers must be free of any retaliation connected to complaining about violations of the labor law.

Wage Theft Prevention Act FAQs:

- Can a worker waive the notice requirement?

No. - Do I have to use the Labor Department’s LS Form templates?

No, employers can develop their own notices so long as they contain all the information required by law. - When are pay notices required?

Notices are required at the time of hire, and when there are changes in the information on the pay notices. - May the notice be included in letters and/or employment agreements provided to new hires?

Yes, but they must also be given the appropriate LS form as well. - Can the notice be given electronically?

Yes, but there needs to be a system where the worker can acknowledge the receipt of the notice and print out a copy of the notice. - What if a worker refuses to sign the notice?

The employer should still give the notice to the worker and note the worker’s refusal on its copy of the notice. - Do employers have to keep a copy of the notice?

Yes. Notices must be kept for six years and be available to the Department of Labor upon request. - Do I have to give a new notice every time a wage rate changes?

Except for the employers in the hospitality industry, notice is not required where there is an increase in a rate and the new rate is shown on the next payment of wages. For any reduction of wage rate, an employee must be notified in writing prior to the reduction being implemented. Employers in the hospitality industry currently need to give a new notice every time a wage rate changes. - What procedures should be followed if an employee has multiple pay rates?

An employer must put all pay rates on the wage statement. - Do workers exempt from state overtime requirements still need to get a pay notice?

Yes. - Does the employer have to identify the specific state exemption for workers exempt from overtime requirements?

No. - What should we do if the worker has multiple hourly or piece rates?

The purpose of the notice is to inform workers of the wage rates that apply to them. Multiple rates need to be identified either on the notice or on a separate sheet attached to the notice. Only the rates used to determine a worker’s pay need be shown on the wage statement for that period. - What about salespersons whose wages are all or partially based on commissions?

Labor Law Section 191(1)(c) already requires commission salespersons to receive and sign for a copy of their commission agreement. This agreement should be attached to the pay notice and a copy of each document kept by the employer. - What if I have a bonus or incentive plan on a weekly or less frequent period?

So long as the employee initially was given a description or it is clearly shown on the wage statement for the period in which it is paid, no additional notice is required. - What about retroactive wage increases?

The amounts need to be noted separately on the wage statement for the period in which it is paid. - Does the notice requirement apply to workers covered by a union contract?

Yes. Union contracts may cover wage rates for multiple titles and not give the specific pay date or other information required by the law. Individual workers need to have notice of the wage rates that apply to them. - Are exempt employees, including professionals, executives, or administrators, excluded from the notice requirements?

No. Since Section 195 does not contain any exclusions or exemptions from the notice requirements, the notice requirements in Section 195 apply to all employees regardless of their exempt status. - What is the penalty for not giving proper notice?

Employers can be assessed damages by the Department of $50.00 per day per worker if proper notice is not given. - Can a worker sue for damages on his/her own?

Yes, but the maximum amount an individual worker can recover is $5,000.00. - How often must wage statements be given?

A wage statement must be given with each payment of wages. - In addition to those items previously required on wage statements such as wage rates, hours worked, gross wages, allowances, deductions taken, and net wages paid are there any new requirements?

Yes. The statement must show the name, address, and phone number of the employer as well as the beginning and end date for the period covered by that payment. - Can wage statements be provided electronically?

Yes, but workers must be able to access their statements on a computer provided by the employer and be able to print a copy for their records. - Will the Department of Labor provide a model wage statement for employers to use?

Because wage statement entries will vary from employer to employer, the Department will prepare a sample statement showing the types of entries that may be necessary. - What is the penalty for not providing a proper wage statement?

Employers can be assessed charges by the Department of $250.00 per day per worker if proper wage statements are not given. - Can a worker sue for not receiving a proper wage statement?

Yes, but damages are capped at $5,000.00 per worker. - What is retaliation?

Any action which negatively affects workers such as discharge, suspension, transfer to another shift, reduction in wages or hours, which is done because a worker has engaged in a protected activity. Even threatening an employee can be considered retaliation. - What are a few employee-protected activities?

Employees have the right to complain to their employer, the Department of Labor, or the Attorney General about a violation of the Labor Law and regulations issued under it. They can file a complaint about these violations and give information about their conditions of employment to the Department, or Attorney General, and testify at hearings or other proceedings. - Does there really have to be a violation for the worker to be protected?

If the worker has a good faith belief that there is a problem in the workplace, their activities are protected. - What happens if I am accused of retaliation?

The Department will discuss the accusation with you and give you a chance to prove that the negative action was not a result of the workers exercising their rights. - What are the penalties for retaliation?

Employers or their agents can be fined up to $20,000 and assessed another $20,000 in liquidated damages. The Department can also request reinstatement of the worker and/or compensation for lost wages. There are also potential criminal penalties but those would be prosecuted by an agency other than DOL.

Navigating the labyrinth of New York State Labor Laws is not for the faint of heart. Knowing which form to fill out, how to fill it out, and of course, when to fill it out requires constant vigilance. Fortunately, payroll companies such as ours, Baron Payroll, are New York State Labor Law, experts. And why not? New York State is our backyard, and local businesses are our neighbors.