Call: 631-266-2500Call: 631-266-2500Client Login Contact Us

Is it time-consuming, every cycle, for you to get all your timekeeping data into your payroll system? Most NY business owners have one system for timekeeping and a second system for payroll, creating a challenge to get your time data accurately transferred into your payroll system. On top of that, you must maintain up-to-date employee records in both systems. Eliminate all these time-wasters, reduce costly errors, and improve your legal compliance with Baron's single system solution.

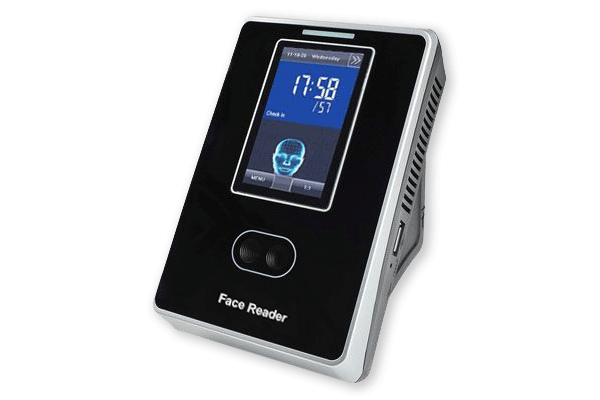

Business owners used finger readers to stop time theft in the old days, but New Yorkers figured out how to beat this system. If they were late to work, they would purposely insert a finger not enrolled in the time clock, and the clock announced "try again," and no punch was recorded. Then, two days later, when asked what time they arrived, the employee says "their regular time" - and they just stole time from you.

We have a solution. We indeed have ten fingers, but we only have one face. The instant the clock sees your face, it clocks you — nothing to touch, no human contact, except standing in front of it. New York business owners tell us these face clocks pay for themselves in less than two months, and all the savings after that goes right to their bottom line.

New York employers are burdened with many additional state and local regulations. New York amended the Wage Theft Prevention Act in 2020 to impose additional recordkeeping obligations on NY business owners. New York business owners are required to maintain, for not less than six years, "true and accurate payroll records showing for each week worked the hours worked; the rate or rates of pay, etc."

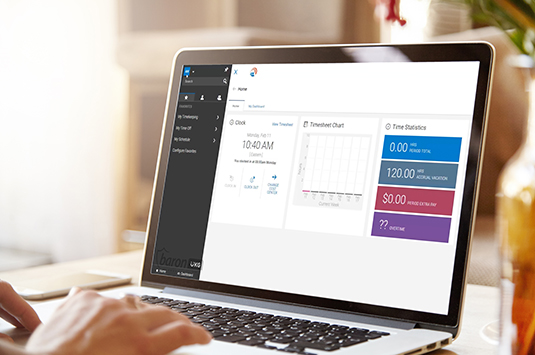

Baron will help you comply with NY laws. Included on every employee's pay statement is their timesheet for the pay period. Everything New York business owners need is in one place on the pay statement, easy to find, and quick to produce. Our documentation satisfies the Department of Labor requirements during an investigation or audit. The DOL is itching to get at your money, and these pay statements will stop the DOL from billing you for backpay, double-liquidated damages, fines, and penalties because you couldn't provide records quickly.

Streamline employee scheduling and put the right people where they’re needed most. Our solution proactively builds schedule recommendations based on operational demand, required skills, compliance rules, and your employee’s availability and preferences. Use our all-in-one platform to create meaningful schedules that meet the needs of your business.

Stop wasting your time doing employee scheduling manually or in a separate system. Instead, quickly generate schedules using the same database of employees you use for payroll, HR, and time and attendance. Your employees will log in from any device and choose from seven different language preferences, including Spanish. Your employees set their scheduling preferences, so your managers can take them into account when building schedules. In addition, your employees and managers can communicate easily using our built-in, two-way texting functionality.

You choose which collection method, or combination, works best for your business. Baron's clocking lineup includes biometric face clocks, a mobile app for smartphones with GPS location tracking, or a computer with IP lockdown restrictions. All these will improve your compliance and protect you and your business from paying employees when they're not working.

Did you know New York added over 20 new employee compliance regulations in 2020 alone? New York business owners cannot go it alone. It would be best if you had serious support, expertise, and technology to comply. Switch to Baron, be in the know, and avoid costly surprises.

Want to prevent a dispute with an employee over sick pay? Use our technology and expertise to track sick pay earned and used efficiently. As a result, NY business owners will always have accurate sick pay records, and your employees will always know how much time is available for them to use.

Your company is not making any money when you're calculating payroll. So why is it always your top person doing payroll? That's why you need great technology, an automated approach, and an efficient process. Switch to Baron and get all these things, including a substantial ROI.

Flexibility is key with Baron. We work to find the best timekeeping solution for your business. Here's what our New York customers say about Baron's time and attendance solutions.

The Ultimate Kronos Group (UKG) started in the time clock business in 1977 and built a huge business. Baron's partnership with UKG enables Baron to leverage the behemoth software company's reliability, data security, and deep technical expertise required in the HR and payroll space.

With more than 700 engineers working on enhancements to keep innovating this HR and payroll product, Baron's clients can sleep easily at night knowing whatever regulations, changes, or obstacles are thrown their way, there's $40 million, and a team of engineers ready to respond.

Timesheets Print On Your Employee's Pay Statements. If other payroll companies could do this, they would, but they can't. Baron uses a single system with one database, so it's a no-brainer to print the timesheet details on your employee pay statements. If the Department of Labor ever investigates you, you're safe because your employee's timesheet hours always match the hours you paid the employee, right down to the hundredth of an hour.

New York Sick Time Compliance. In New York State, most employers are required to provide paid sick time to their employees. As per the regulations, your employees will accrue one hour for every 30 hours worked, up to the limit. Your employees can easily access and monitor these accruals and paid sick leave usage at any time as required by law.

Enforce NY Meal Break Rules and comply with NY laws. In New York, after working six or more hours, your employees must get a thirty-minute unpaid meal break. Easily document all meal breaks on your employee timesheets so you can prove your employees received their meal breaks.

Face Clocks for Small Businesses. Some biometric clocks can cost upward of $3,000. Our Face Clock isn't one of them. Instead, it costs about $600. And the setup is quite painless.

Use Our Mobile App and fundamentally change the way your workforce interacts and connects with your organization. Deliver easy and immediate access to your managers and employees. Employees can use the app to clock in and out, check schedules, place time-off requests, review paychecks, and more.

Restrict Employee Punches on the mobile app based on location. For example, use geofencing and only allow your employees to clock in within the radius of a defined area, down to the tenth of a mile.

Quickly Retrieve and Produce Data for DOL Audits or Investigations. Are you prepared right now to quickly retrieve and produce employee information for terminated employees who worked for you five years ago? If you're using Baron's technology with paperless records, the answer is yes!

Time-Off Request System means less confusion and no paper. Your employees can use their login to see their time-off balances and request time off. You have a choice to approve or deny their requests, using our automated process inside your single system for everything HR and payroll.