If you’re a business owner, you may have heard of ITIN numbers and wondered why they’re important. An ITIN (Individual Taxpayer Identification Number) is required for any non-U.S. citizen employee who works in the United States and needs to be reported on your payroll tax returns. But how much does it cost to get an ITIN number for your employees? And can you add ITIN workers to your payroll?

ITIN is complicated.

And I know your time is valuable, so here are the short answers:

1. Getting an ITIN number is free through the IRS.

2. Yes, you can add your ITIN workers to payroll (but Baron Payroll is one of the only companies to do it).

So, with that said, you might be wondering...

Why has Baron Payroll been adding ITIN workers to payroll for over twenty years when other companies won't touch them?

And to answer that, you have three options.

1. You can download the PDF below and get everything you need to know about ITIN as an employer.

2. You can book a meeting with an ITIN advisor and get all your questions answered.

3. You can keep reading and find the answers for yourself.

Ready?

Let's go.

What is an ITIN Number?

An ITIN number is a unique nine-digit identification number issued by the Internal Revenue Service (IRS) to individuals who are not eligible for a Social Security Number (SSN). It is typically used by individuals who do not have an SSN but still need to file taxes in the United States.

How Much Does IT Cost to Get An ITIN Number?

The good news is that getting an ITIN number is free! However, if your worker chooses to use a tax return preparer or other paid service provider, there may be additional fees associated with their services.

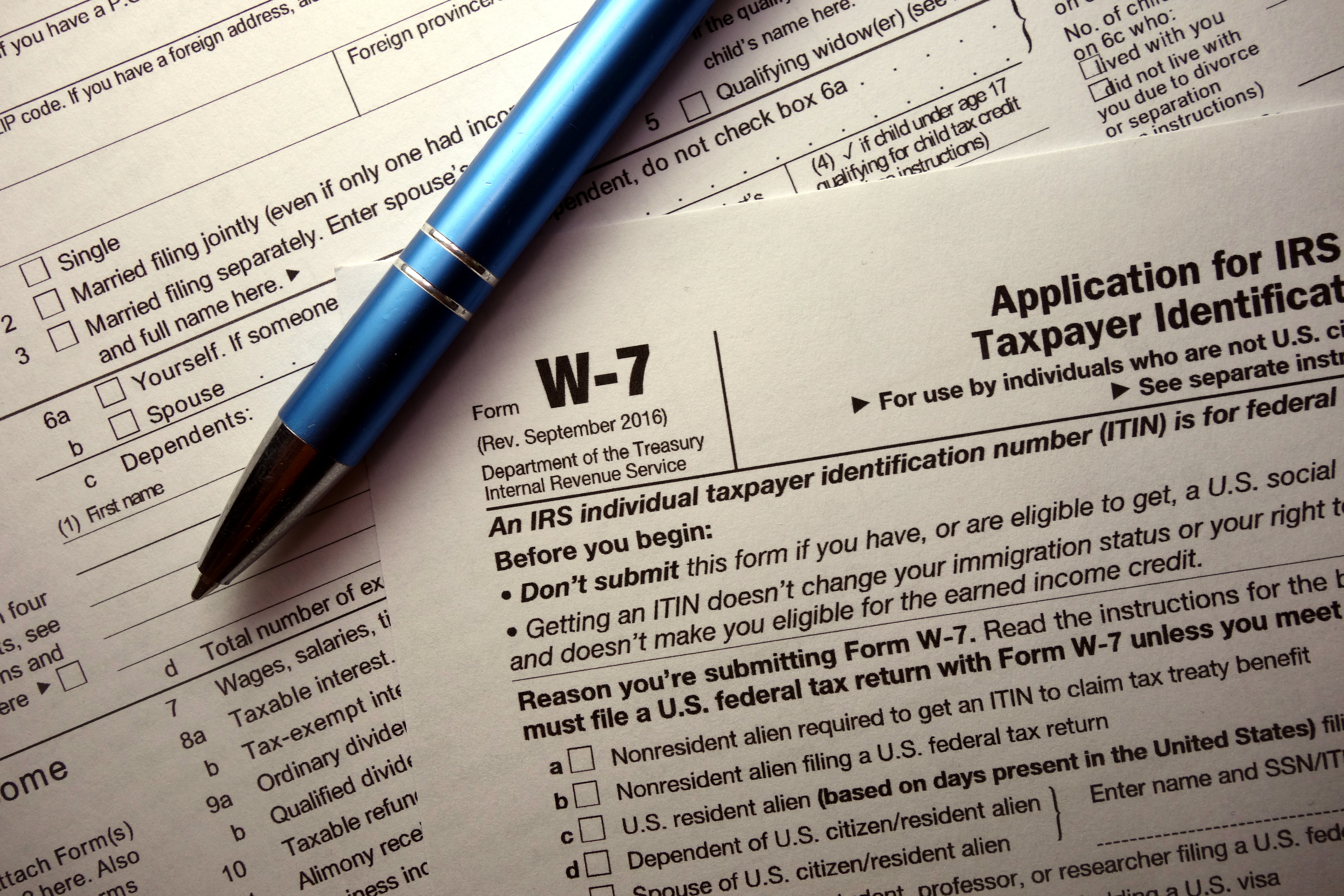

What Form Do Your Workers Need To Fill Out?

Your workers will need to fill out form W-7 in order to apply for an ITIN number. This form must be completed accurately in order for them to receive their ITIN number without any issues.

The form also requires supporting documentation, such as a birth certificate or passport, so make sure they have those items at hand when they go through the application process.

When Should Your Workers Apply?

Your workers should apply for an ITIN as soon as possible because applying for an ITIN does take time; once the application is received by the IRS, it may take up to 7 weeks for them to process the request if they qualify for an ITIN number.

Is There A Fee To Renew An Expired or Revoked ITIN?

Yes, there is a fee if your worker's existing ITIN has expired or been revoked due to non-use over the last five years. If this applies, they'll need to fill out Form W-7 again along with all the necessary supporting documents and pay a processing fee per submission directly to the IRS.

Can ITIN Workers Get On Your Payroll?

Yes! With Baron Payroll, your workers with an ITIN number can become employees and can be added to your payroll.

Here’s the big issue, though. Most payroll companies will not let you add ITIN employees to your payroll - but we will. Baron Payroll has been paying ITIN workers on payroll for over twenty years, and we can do the same thing for you!

Wondering how much it costs to work with Baron?

Use our instant pricing calculator to get your estimate.

What Are The Benefits Of Having ITIN Numbers and Adding These Workers to Your Payroll?

There are three big benefits for your workers to get an ITIN number and for you to add them to your payroll:

1. Payroll Tax Compliance

Having workers with ITIN numbers allows you to pay them on payroll and comply with all the payroll tax regulations—which helps you minimize your financial risk related to potential audits from federal and state agencies.

2. Department of Labor (“DOL”) Compliance

Additionally, paying your workers on-the-books as ITIN employees, rather than off-the-books, also helps you minimize your financial and compliance risk related to potential investigations from both the federal DOL and your state DOL. 3. Workers Comp Compliance

3. Workers Comp Insurance

And last but not least, your workers will have workers comp insurance in case they get injured on the job. Otherwise, you would probably have to pay these medical costs out-of-pocket.

Additionally, you will be in compliance with the workers comp laws and avoid stiff fines and penalties (up to $1000 per day).

Are You Looking to Put Your ITIN Workers on Your Payroll?

- Have you been told it's not possible?

- Have you been told it's not legal?

- Are you worried about the DOL?

- Are you worried about your ITIN workers getting injured and not being covered by workers comp?

If so, then we can help.

At Baron Payroll, we are experts at managing the complexities of adding your ITIN workers to payroll, and we’ve been doing this successfully for over 20 years.

And the best part is that we’ve included our ITIN package for FREE with our payroll services.

Below is a list of ITIN services included for FREE:

ITIN Worker Payroll Integration

With our ITIN workers payroll integration, you’ll be able to add your ITIN workers to payroll, same as you do for your other employees. And at the end of the year, your ITIN workers will get a W-2 form same as your employees.

It’s that easy.

Spanish Language Payroll Platform

Our multi-language payroll platform supports a variety of languages, including Spanish.

Your Spanish language workers are able to use our free phone app in Spanish. They can clock in/out in Spanish, see their pay statements in Spanish, and even see how much paid time off they have available in Spanish.

Essentially, they can see as little or as much as you want them to see, all in their native language, eliminating questions back to you and your office staff.

Wages On Demand (Payroll Advances)

Inflation is high, and it’s putting more financial pressure on your ITIN workers and employees than ever before.

Unfortunately, payday isn’t every day… Or is it?

Wouldn’t it be great if your employees could have instant access to their earned wages when they need it?

What if your employees could have this flexibility without borrowing your money and creating extra work for you?

Introducing Wages On Demand.

It’s between your employee and Wages On Demand. You are out of the picture entirely.

When your employee needs a cash advance, they use the app on their phone to get one.

The best part?

If an employee does not pay back what they owe, this does NOT affect you, the employer, at ALL.

Welcome to the future.

Payroll Debit Cards for Your ITIN Workers

For the same reason ITIN workers cannot get a social security card, most of the time, they also cannot open a bank account.

Without a bank account, you’re forced to pay them with a check.

WRONG.

Our payroll debit card solution offers a hassle-free way to pay your ITIN workers with direct deposit, even though they don’t have a bank account.

Payroll cards are reloadable, can be used for purchases, offer various withdrawal options, and eliminate expensive check cashing fees.

And that's it!

That's everything you and your ITIN workers need to save you time and money.

And remember, our ITIN package is FREE with our payroll services. Wondering how much our services cost?

Get your instant price now without even speaking with a salesperson.

Use our pricing calculator to get your instant price estimate today!

Are You Paying Too Much?

Send us your payroll invoice and get a FREE 10 min call to see if you’re getting ripped off.

Do you have ITIN workers?

Are you upset because your payroll company can't help?

How Much Does It Cost?

See detailed pricing now for each service without talking to a salesperson.

If you found this article helpful, here are some others you might like: