Payroll Manager Christine Campanella shares her knowledge on payroll service portals, payroll taxes, labor law compliance, customer service, and more.

Today, we have the pleasure of speaking with Baron Payroll’s Christine Campanella. An expert on navigating payroll self-service portals, and all things payroll, Christine is the voice you long to hear when you need payroll assistance. Let’s hear what she has to say.

“Hi, I’m Christine Campanella. I’m the payroll manager here at Baron Payroll. I’ve been working here since 2014, and I’m usually the voice that you hear on the other end of the phone when you’re calling for payroll assistance. We help clients with a variety of personal services. And usually, we know them on a one-to-one basis.”

BP: Christine, it’s great having you here today. When it comes to payroll, I’m curious to learn what clients are concerned about. For instance, what question do you wish you had a nickel for every time you heard it?

CC: That’s easy! “I’m locked out of my Baron Payroll APP! How can I get back on my self-service payroll portal?”

BP: What do you tell them

CC: First off, I tell them not to worry. Then I have a series of questions such as: Are you using the correct website (secure2.saashr.com)?

I also ask if they’re using the correct format for their username. The correct format is their capitalized initials, with the rest of their last name in lowercase.

BP: What about forgetting their self-service payroll portal password?

CC: Yes, I hear that quite often. People call and say, “I forgot my password!” Worse yet, “I tried unsuccessfully three times and I got booted out. Can you tell me my password?” To which I reply, “No, but I can reset your password for you. Simply log on again and use the new temporary password, and you’ll be good to go. Make sure to change your password after you’re logged in.”

It's easy to do. Of course, when you have a tight payroll deadline, it can be understandably frustrating.

BP: Are there any payroll outsourcing features that more New York employers should make use of more frequently?

CC: Yes, employers without their own HR department, should consider making more use of our HR Support Center. It’s a tremendous resource!

BP: Do you have a new payroll client onboarding checklist?

CC: Yes. Here’s what our standard checklist looks like.

- Signed SOW (Statement of Work)

- Electronically Signed Federal and ACH Documents via Lincware

- Schedule Implementation Meeting

- ACH Vendor Enrollment

- Bank Account Check

- Workers Comp Policy

- Disability/PFL (Paid Family Leave) Policy

- Office Tools/Client Notes Page

- New Client Intake Form Processing

- Quarterly Reports

- Return Electronically Signed Federal and ACH Documents via Lincware

- Welcome Email

- Service Portal Modules such as TLM (Time Labor Management) Module Build to Client Specs

- Payroll Module Build with Earnings Codes, Deductions, Bank and Employee Info, and Prior Payroll Info

- HRIS (Human Resources Information System) Module Build

- Run Parallel Payroll—to Make Sure New Payroll Synchs with Old System for Taxes, Gross Pay, Net Pay, and More

- EFTPS (Electronic Federal Tax Payment System)/NYS Online Tax Center Setup—This Ensures That Client Taxes Are Paid Correctly and On Time

- Schedule Training—Takes 15 Minutes-2 Hours Depending on Complexity

- Send Termination for Old Service Provider

- Fax Federal 8655 Form

- Activate Notification in Proprietary Software

- Change Payroll Processor

- Enter Billing/Finalize Billing

- Poster Compliance—Annual Up-to-Date Labor Law Poster

- HR Rapid Response—For Employers Without an HR Department

FAQs for Employers

BP: Where do I find my tax documents?

CC: Just log on, click the three lines on the top left, click the star for your favorites, and then go to the area marked tax documents.

BP: Which tax documents can I view?

CC: You can view your federal and state quarterly tax documents. For example, your NYS-45 (Quarterly combined withholding wage reporting), Form 941 (Employer’s quarterly federal tax return), and NYS MTA-305 (Employer’s quarterly metropolitan commuter transportation mobility tax return).

BP: What about fourth-quarter tax documents?

CC: Yes, you can view those as well. For the fourth quarter, you can view your Form 940 annual federal unemployment tax return.

BP: Christine, this is helpful. Wouldn’t it be great if employers could have this information at their fingertips?

CC: It’s funny you should say that, because I was just thinking about suggesting employers bookmark this blog article—it would make their lives much easier.

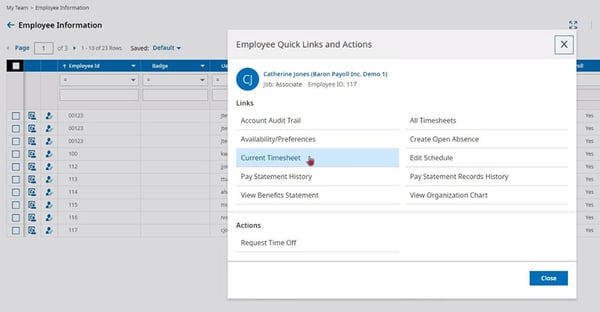

BP: Where can I see the mobile time and attendance punches when someone clocks in with the mobile APP – where does it show the location of the punch?

CC: The mobile punches are on your current timesheet located in the employee information area under Quick Links.

BP: Would this include an employee’s physical location?

CC: Yes, provided the employee’s cellphone has location services set to on.

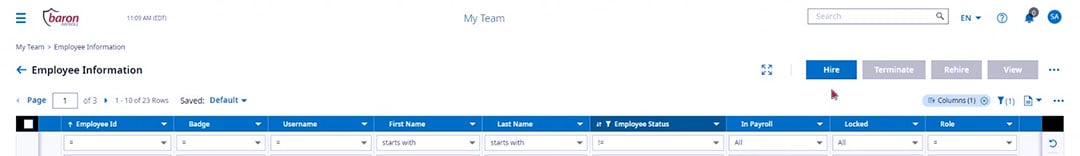

BP: How do I add a new employee?

CC: Go to the three lines at the top left, click the star for favorites, click employee information, and then click the big blue button on the top right marked Hire. After you do this, simply answer the questions.

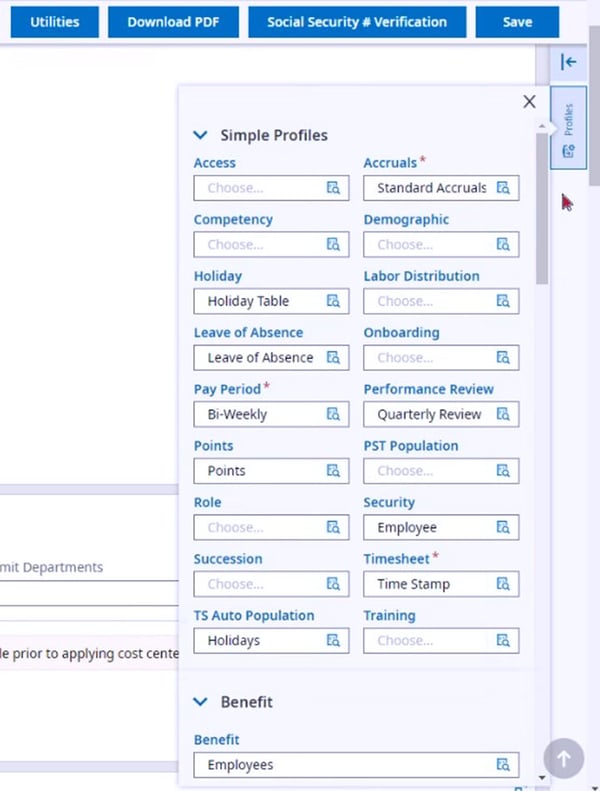

BP: Are my company’s policies reflected each time I add a new employee?

CC: Yes, the profile tabs on the right side of the main menu show the policies your company offers. These policies can include PTO, holidays, pay periods, 401K, and schedules.

BP: How do I edit the timesheets?

CC: From the employee information screen, click the Quick Links icon next to the employee’s name, then click on the words Current Timesheet, and you can then edit whichever day you need, and click Save.

BP: How can I see accrual balances?

CC: This depends on whether we’ve built an HR tab in your software package. If you decide midstream that your business might benefit from this, simply contact us and we’ll set it up for you.

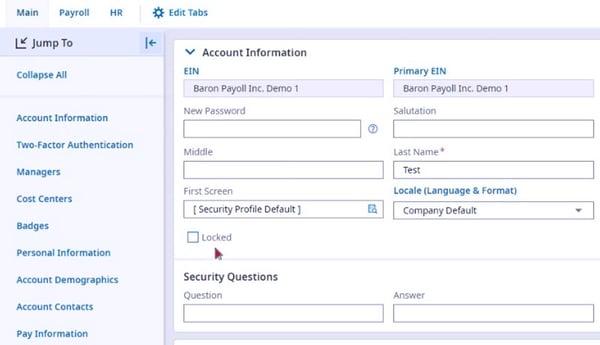

BP: How do I unlock an employee who cannot get into their ESS portal?

CC: From the employee information screen, choose the locked-out employee, go to their main page, and simply uncheck the box that reads “locked.” This is in the account information area.

BP: Where can I find my employee’s paystub?

CC: That’s located on the employee information screen. Choose the employee’s Quick Link and click on the words “Pay Statement History.”

FAQs for Employees

BP: How can I get the Baron Payroll mobile APP for my cellphone?

CC: Just go to your cellphone Appstore and download HCMToGo APP.

BP: Where can I find my paystub?

CC: It’s in your mobile APP in the My Pay section. Click on the words “My Pay.” And that’s all there is to it. You can select from recent and historical options.

BP: How do I request time off?

CC: From the mobile APP, click the three lines on the top left, click “My Time,” click “Time Off,” and then click “Request.”

BP: Where can I see my time off balances?

CC: From the mobile APP, click the three lines on the top left, click “My Time,” click “Time Off,” and then click “Balances.”

BP: How do I change my direct deposit?

CC: To change your direct deposit information, please contact your company payroll representative.

Questions clients ask the payroll processors

BP: I have a new hire, what paperwork do I need them to fill out?

CC: Each new hire needs to fill out a W-4 form and an I-9, and if they’ll be working in New York State, they also need to fill out an IT-2104, and an LS54/56. These are the only requirements. You may also want new hires to fill out a direct deposit form, too.

BP: I am hiring a new employee and they want to bring home a certain amount, can you calculate their gross pay to make this happen?

CC: Yes. You would need to set up a gross-up paycheck in the Add/Edit Pay Statement Area in a payroll run. This will automatically calculate the taxes and give you their gross pay per pay period.

BP: What is the minimum hourly pay rate? What do I need to pay a salaried person in Long Island, New York State, and New York City each week to make them exempt?

CC: The minimum hourly pay rate is $15.00 in Long Island, Westchester, and New York City. As of 12/31/2021, the rest of New York State is $13.20 per hour.

New York State workers must earn a minimum of $58,500 per year to be considered a salaried/exempt employee.

BP: Do I always need to pay an employee overtime?

CC: This is determined by whether your employee is a salaried or an hourly employee. Hourly employees must be paid overtime after 40 hours.

BP: We have a returning employee; do I need to enter all their info again? How can I make them active again?

CC: In the employee information screen, remove the word active from the sort on the column labeled employee status, and all your non-active employees will be listed, then click on the employee information button at the front of the line for the selected employee, then go to the dates area and click “rehire.”

The best practice would be to confirm that their address, direct deposit, and tax filing information hasn’t changed.

BP: We have an employee who has a SS# that starts with a “9”, can we still hire them?

CC: Yes. Baron Payroll can accommodate ITIN employees.

BP: I am going on vacation, can I run payroll from my hotel room?

CC: Yes. Simply log on to our website and process payroll as usual.

BP: I am going on vacation and will not have access to a computer, what do I do?

CC: You have two choices. You can arrange to have Baron assist someone at your office over the phone, or Baron can do it for you. So, sit back, relax, and enjoy your well-deserved holiday.

BP: I don’t understand the new Federal W4 form, how do I fill it out?

CC: You’re not alone. Please view our Drastically Different W4 for 2021 video to learn more about the Federal W4 form.

BP: My employee quit and has our laptop; can I hold their paycheck until they bring that in?

CC: Based on applicable New York State labor laws, you still must pay your employee. However, you can require that the employee pick up their paycheck in person. Hopefully, this will motivate the employee to return to company property. Whether they do or not, employers must still give them their paycheck.

BP: My employee owes us money for products they took home, can I just deduct the amount from their next paycheck?

CC: Yes, but you must get written permission from the employee first.

BP: My employee is out sick with COVID, and they do not have any sick time left, do I have to pay them?

CC: The short answer is, no. Due to the unpredictable nature of COVID legislation, what’s true today may change tomorrow. This is one of the reasons why it’s so important to work with a skilled payroll service provider.

BP: Oops, I forgot to pay one employee (or all) and today was payday, what are my options?

CC: You can write or print paychecks from the company checkbook and ask Baron to run the payroll information through the next payroll. You may also run a same-day payroll providing you’re able to get your bank to wire the funds to the Baron Payroll funding company by 12 noon. This option will direct the funds to the employee’s direct deposit account by 5 pm. Please make sure you contact Baron ASAP when this occurs.

BP: My employees are constantly asking about the amount of PTO time they have left; how can I avoid this?

CC: If you have a PTO policy built into the employee APP, then they will be able to check their balances under the Time-Off area.

BP: Thank you for being available for this interview. I look forward to asking you more payroll-related questions in the future!

CC: Absolutely, my pleasure!